August 22, 2017

Bringing App Interoperability to the Financial Desktop

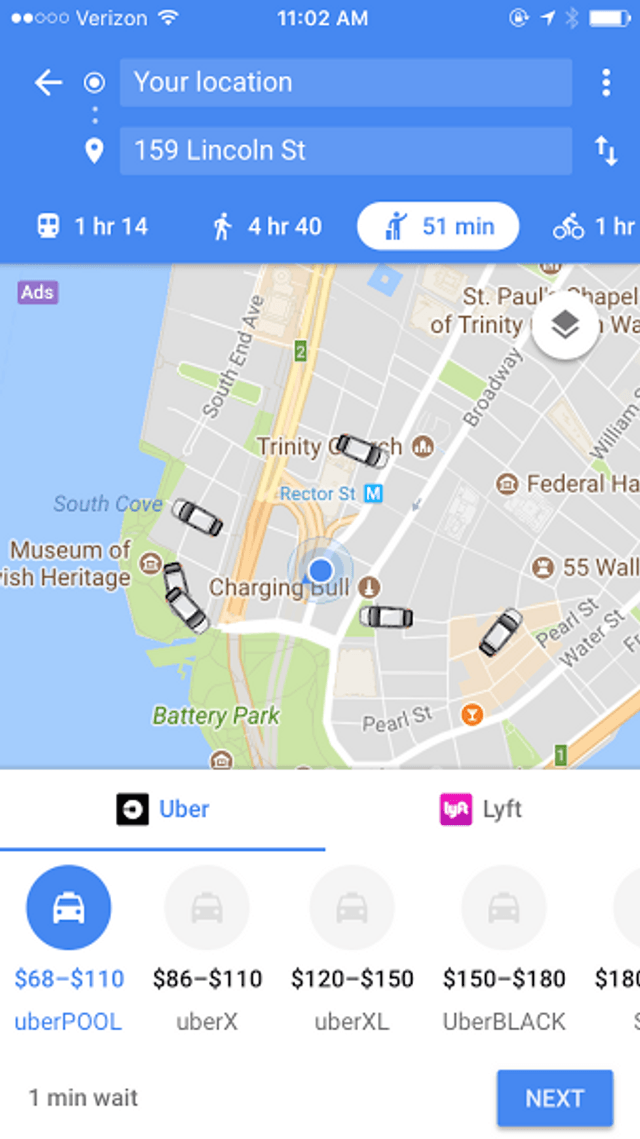

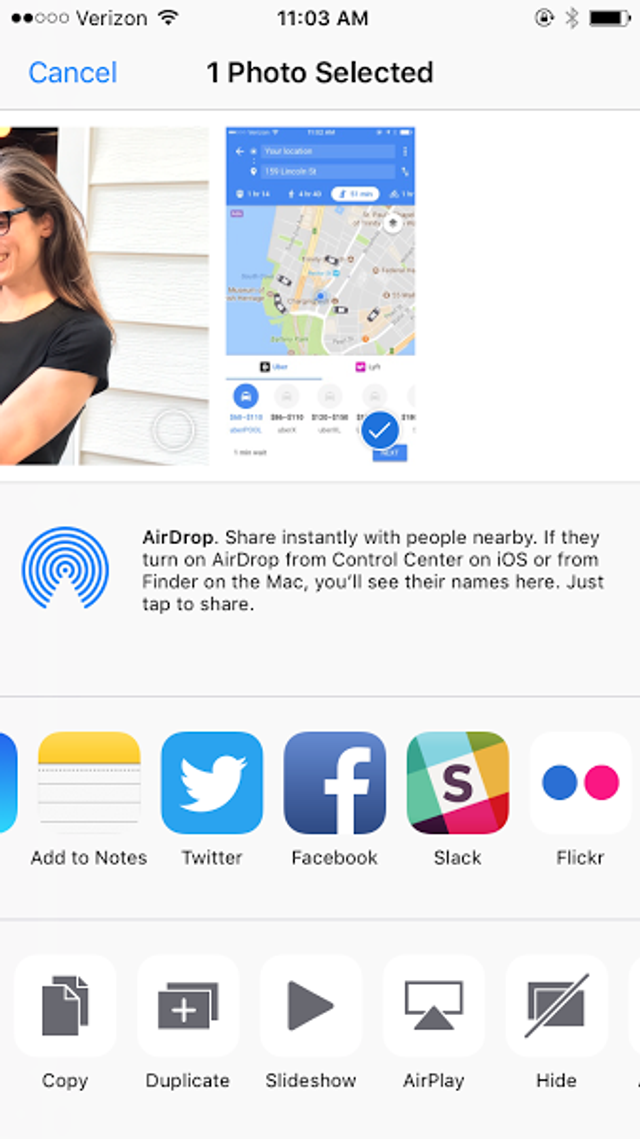

Interoperability is a magical thing. There’s a certain element of delight when two things work together the way we expect them to. On our personal devices, this happens by default. From our Calendar app, we tap an address that opens up the Maps app and searches for the address. From the Maps app, there is an option to open up the Uber app to travel to that location. From the Uber app, we can share our location with the person we’re meeting.

Interoperability in mobile is ubiquitous and by default

Interoperability makes us more productive in our personal lives. But on trading and sales desks, where there are literally millions of dollars at stake when making real-time decisions, this delight is conspicuously absent. If there is relevant real-time market data or news on a security, you’d like to see it before you hit that Buy or Sell button, which means you want your news and market data platform to be aware of the state and context of your trading platform, and push information to where you are in the moment. Or, when a customer calls asking for a price, you’d like to know that someone went to see them yesterday and maybe your hit rate with that customer, which means you want your inquiry system connected with your CRM and your trade analytics system.

On the financial desktop, end users ARE the de facto integration layer

Interoperability is critical to streamlining workflow, improving productivity, providing traders and salespeople with better intelligence and so much more. But this goal has been elusive until now. At OpenFin, we believe the time has come to connect up all of the industry’s applications and we’re committed to solving this problem with open standards and open source.

In addressing interoperability on the financial desktop, we believe that there are 3 major pieces of infrastructure missing in the industry today:

- the ability to discover and verify a trusted app

- a common message bus that is open source and not tied to any one platform

- a standard taxonomy for workflow and context across apps

Let’s take these topics one at a time.

App Discovery and Verification

Mobile OSs provide strong identity and discoverability through app store registration. However, the app store model – as noted above – creates a silo effect that inhibits interoperability outside of the store walls. Vendors in the financial space have already introduced app stores. What is missing is an App identity that can federate across platforms. To support a common identity, the industry needs a distributable and hierarchical directory that can resolve and verify identity and allow local identities for apps private to a bank or other organization.

Common Message Bus Infrastructure

Just as most platforms in the industries support passing messages, most of them expose their own message bus. Each of these buses are tied to the technical and commercial specifics of their respective platforms, making them ill suited for providing a common bus layer that can be present across the industry.

What is needed to support cross-industry interoperability is a message bus which is:

- Available under a free license

- Built on open source technology

- Not tied to specific data or trading platform

Taxonomy for Workflow and Context

Interoperability requires agreed upon objects and verbs to do anything of real value. Today, most platforms can pass messages. However, there is no standard format for these messages, and no lowest common denominator of functions is defined that all platforms can support. A standard for the industry should define:

- A protocol for handshake between apps

- An extensible taxonomy for app workflow verbs – such as Charting, Quote, OMS, EMS, etc.

- A protocol for discovering and executing functions

- An extensible taxonomy for context shared between apps – such as instruments, organizations, geographies, etc.

Towards an interoperability standard

As app development and the number of platforms and app stores across the financial desktop proliferate, we now have an opportunity to advance a common set of capabilities that will set the stage for a new generation of development in our industry. At OpenFin, our focus has been on building the platform and interoperability layer to support this ecosystem. As open technologies like JavaScript and HTML5 and modern, open source approaches to development become the norm in finance, the opportunity to parlay common tech stacks into workable standards becomes even stronger. The time to move forward on interoperability – as an industry – has never been better.

Enjoyed this post? Share it!

Related Posts

All Posts ->

Featured

Enhanced Deployment Flexibility with OpenFin's Fallback Manifests

Thought Leadership

Featured

ING Integrates OpenFin for Salesforce to Optimize Workflows

Thought Leadership